HOW TO ENFORCE A COURT JUDGMENT – PART TWO

/In Part One we reviewed the steps that a successful party, the judgment creditor, needs to take in order to enforce their judgment should the losing party, the judgment debtor, fail to pay a judgment. We considered how to obtain further information about the debtor’s assets, how to receive money from the debtor's employer and how to obtain money from the debtor’s bank account.

In Part Two, we will look at the process for securing a lien over a debtor’s real property before turning our attention to how we can enforce a judgment against a business debtor. Finally we will consider how to recover the costs a successful party is forced to incur when enforcing a judgment.

Securing a lien over the losing’s party’s property

By placing a lien over any real property owned by the debtor, the debtor will not be able to sell or refinance property until the judgment is paid in full. You do not have to provide the address of the property to impose a lien, nor do you even need to know for certain that the debtor owns property. A lien will be placed on any property that is in the name of the debtor. The best approach is to record a lien in the county or counties where the debtor resides or does business. The judgment is valid for ten years and the lien will stay in place for the duration of the judgment. If need be, the judgment can be renewed before the end of the ten years.

If the debtor owns property in Marin County we will need to take an issued Abstract of Judgment to the County Recorder’s Office. The lien will be recorded for a fee of $25. If the debtor owns property in another county, we will also need to deliver the issued Abstract of Judgment to the Recorder’s office in that county (a further small fee will be required).

Seize money of a business ("till tap")

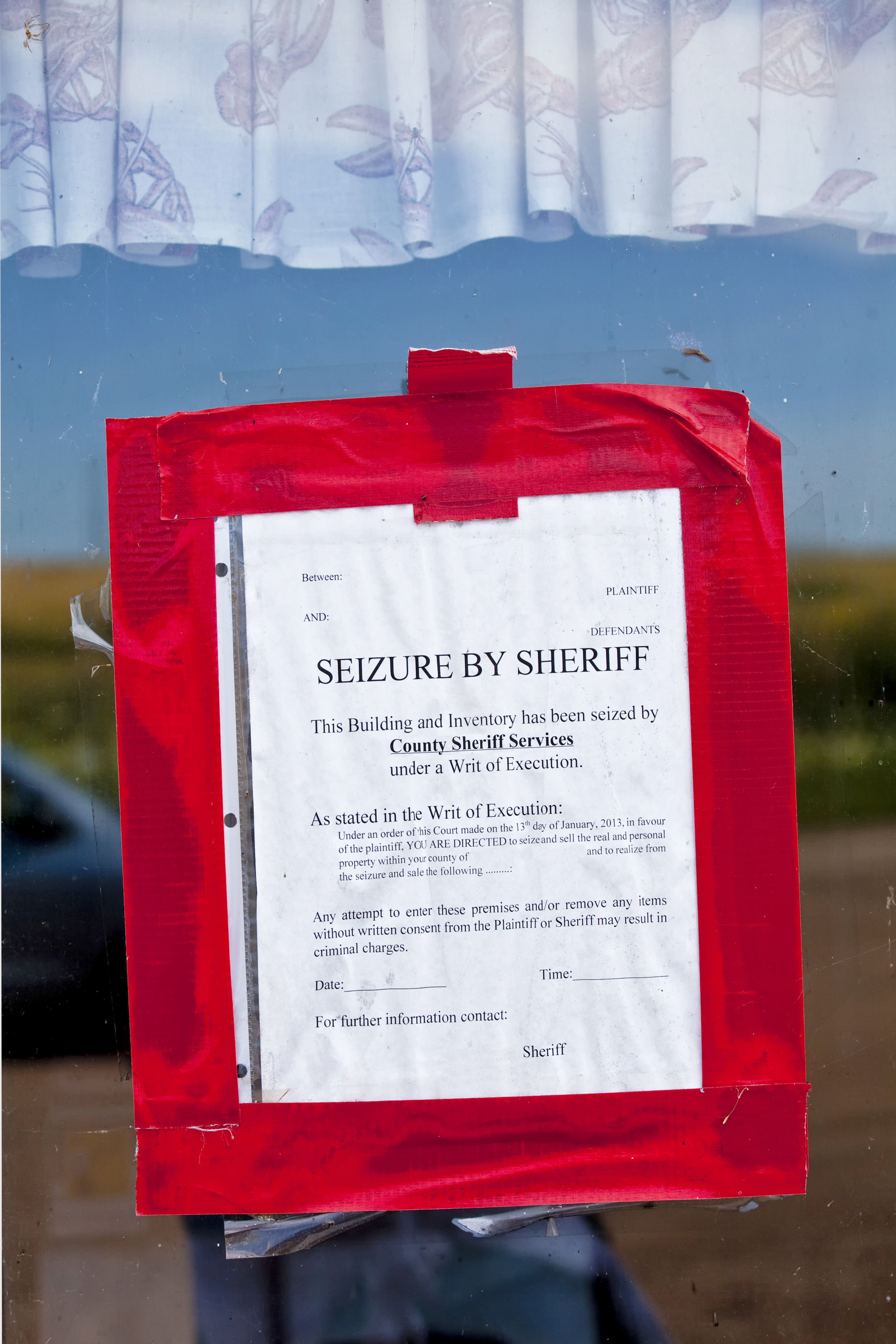

If the judgment debtor is a business which has a cash register, we can get the Sheriff to go to the business and take money out of the register to pay the judgment and the Sheriff’s fee. This method of collection, known as a "till tap", is favored as it is relatively quick and is not as expensive as putting a Sheriff’s "keeper" in a business, which is discussed below.

To tap the debtor's till we will need to provide the Sheriff’s Office with an issued Writ of Execution as well as Sheriff’s Instructions, including the name and address of the business and the best time of day to do the "till tap." The Sheriff will then go to the business address, take what money is in the cash register and serve the debtor with a Notice of Levy.

If there is not enough money in the register to pay the judgment on the day the Sheriff goes to the business address, you have the option of sending the Sheriff back on another day, although a fee will be due every time the Sheriff goes back. The Sheriff’s fees are recoverable and can be added on to the judgment amount and other expenses. However, there is no guarantee that a collection can be made and the Sheriff's fees will need to be paid by you regardless of the amount of money seized.

The judgment debtor may challenge the seizure of their personal property by filing a Claim of Exemption with the Sheriff. We will then have to oppose the Claim of Exemption and a hearing date will be set for the court to consider the debtor’s objections.

Seize the money and personal property in the debtor’s business ("keeper")

If the judgment debtor is a business, we can get the Sheriff to place an individual called a "keeper" in the business for a certain period of time. The keeper will collect money received by the business on the day or days you have paid for a keeper to be present at the business.

We can also ask the Sheriff to sell the inventory of the business. The Sheriff’s fees for a keeper can be expensive. The fees will be added to the amount that the Sheriff collects, but there is no guarantee of collection.

To appoint a keeper, we will need to provide the Sheriff’s Office with an issued Writ of Execution as well as Sheriff’s Instructions, including the name and address of the business and day that we want the keeper to be present at the business. You will also have to pay the Sheriff’s fee.

Recovering the costs of enforcing your judgment

In the event that we have to use legal proceedings to collect the money awarded to you under a judgment, you will have to pay court fees, service fees and Sheriff’s fees. You are entitled to add these costs to your original judgment amount provided you have not filed a Satisfaction of Judgment (see below). You must seek the recovery of these costs within two years of the date they were incurred. You can also claim interest at 10% annually from the date of the judgment. Lastly, you must acknowledge any payments that the judgment debtor has made on the judgment.

We will arrange for a Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest to be delivered to the judgment debtor. The person who delivers the Memorandum must complete the proof of service document on the back of the form, which we will then file the form with the court. The debtor will have 10 days to file a motion to dispute some or all of the costs. If no motion is filed, the clerk will add the costs to the judgment. If the debtor files a motion, we will get a notice of the time of the hearing at which the court will decide if you should get paid for the costs you have claimed.

What to do after a Judgment is paid

After you have been paid in full, you must file an Acknowledgment of Satisfaction of Judgment. If you recorded an Abstract of Judgment (to secure a lien over the debtor’s property), when you complete the Acknowledgment form you will have to name every county where you recorded the Abstract of Judgment and sign the form in front of a notary public. You must then record the Acknowledgment in each county where the Abstract of Judgment was recorded. The Recorder will charge a fee.

Recovering money awarded to you by the court can seem as a disheartening and sometimes painful process, but with a good understanding of the options available to you, the steps required and the assistance of reliable legal counsel where needed, the recovery and enforcement framework can be used effectively and efficiently. If you require advice or representation from the McGIll Law Office, please do not hesitate to contact us on 415 508 5323 or email us on inquiry@mcgill-lawoffice.com

Content prepared by Richard Parry. © Richard Parry, 2015

....................................................

This message and the information presented here do not create or evidence an attorney-client relationship nor are they intended to convey legal advice or counsel. You should not act upon this information without seeking advice from a qualified lawyer licensed in your own state or country who actually represents you. In this regard, you may contact The McGill Law Office and then representation and advice may be given if, and only if, attorney Edmond McGill agrees to do so in a written contract signed by him.